|

Insights Application.

Modeling and Forecasting a National Economy as Interdependent System.

|

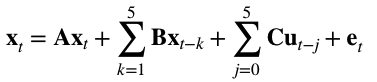

In economic and financial research analysis of economic systems and multi-step ex ante forecasting of key economic parameters are gaining importance. The purpose of such studies is to create preconditions appropriated for expected future developments and to find the laws and factors of influence causing these developments. This example demonstrates the power and results of self-organizing modeling and identification of the interdependence structure of 14 key parameters of the German national economy. This system model (system of equations) developed by Insights in minutes from historical data is then used to autonomously forecast several uncertainty-driven scenarios of all economic parameters five years ahead up to the year 2021 and is compared to corresponding forecasts of the International Monetary Fund (IMF).

Modeling

Given are data of 14 economic parameters of the German national economy of the years 1980 to 2016 (N = 37) as provided by the IMF (World Economic and Financial Surveys, World Economic Outlook Database, 2016), which can be a priori divided into endogenous or state variables x and exogenous variables u:

x2: Gross domestic product, deflator

x3: Gross domestic product per capita, constant prices [Billion EUR]

x4: Output gap in percent of potential GDP [%GDP]

x5: Gross domestic product based on purchasing-power-parity (PPP) per capita GDP [USD]

x6: Gross domestic product based on purchasing-power-parity (PPP) share of world total [%]

x7: Total investment [%GDP]

x8: Gross national savings [%GDP]

x9: Inflation, average consumer prices

x10: Volume of imports of goods and services [%change]

x12: Unemployment rate [%]

x13: Employment [Mill]

x14: Population [Mill]

u11: Volume of exports of goods and services [%change]

x2,t = f2(x1,t, .)

x3,t = f3(x2,t, .)

Results

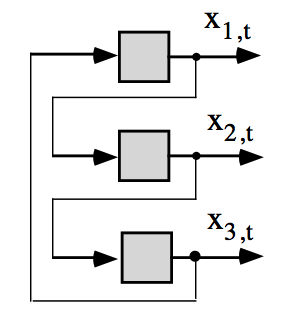

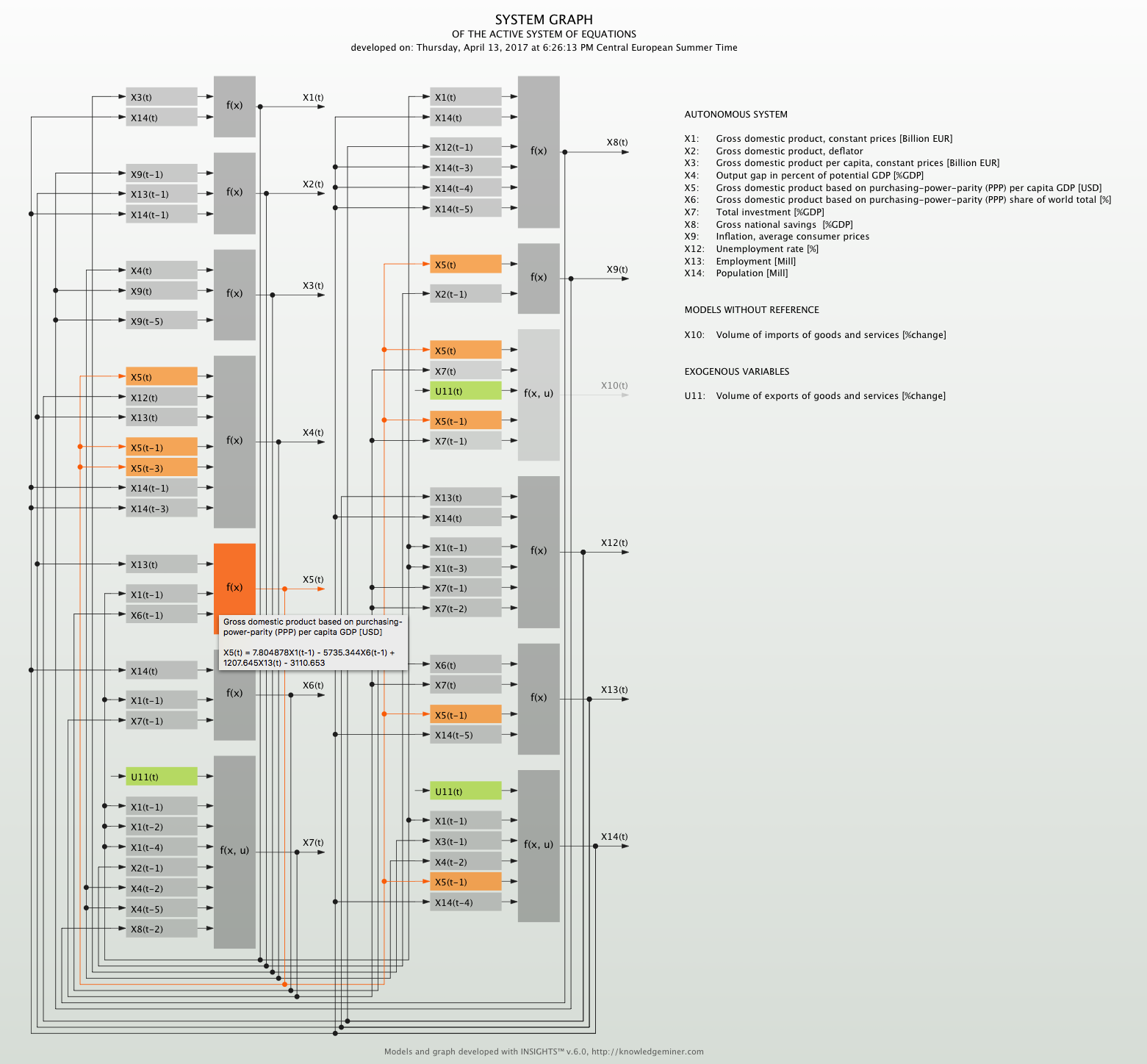

As a result of noise and uncertainty in the input data for modeling Insights generally provides not only one best but a number of qualitatively and quantitatively comparable models according to model accuracy. Therefore, a set of system models is developed implicitly. One self-organized system of equations is given below and the corresponding identified interdependence structure of the autonomous system is shown in figure 2.

x2(t) = 0.4980568x9(t-1) + 2.011354x13(t-1) + 2.958109x14(t-1) - 262.6105

x3(t) = 296.7671x4(t) + 144.5323x9(t) + 129.4768x9(t-5) + 7295.092

x4(t) = 0.00136263x5(t) - 0.0006133768x5(t-1) - 0.0007974957x5(t-3) - 0.9018034x12(t) - 0.5752203x13(t) +

+ 1.256526x14(t-1) - 0.5413245x14(t-3) - 32.00273

x5(t) = 7.804878x1(t-1) - 5735.344x6(t-1) + 1207.645x13(t) - 3110.653

...

x14(t) = 0.03410858x1(t-1) - 0.001863582x3(t-1) + 0.1238598x4(t-2) - 0.0003100284x5(t-1) +

+ 0.03877476u11(t) - 0.1946272x14(t-4) + 80.66718

This graph is interactive in Insights: When clicking on a gray model box the selected model gets highlighted and the references of this model are shown along with the model equation for quick overview.

Ex ante forecasting

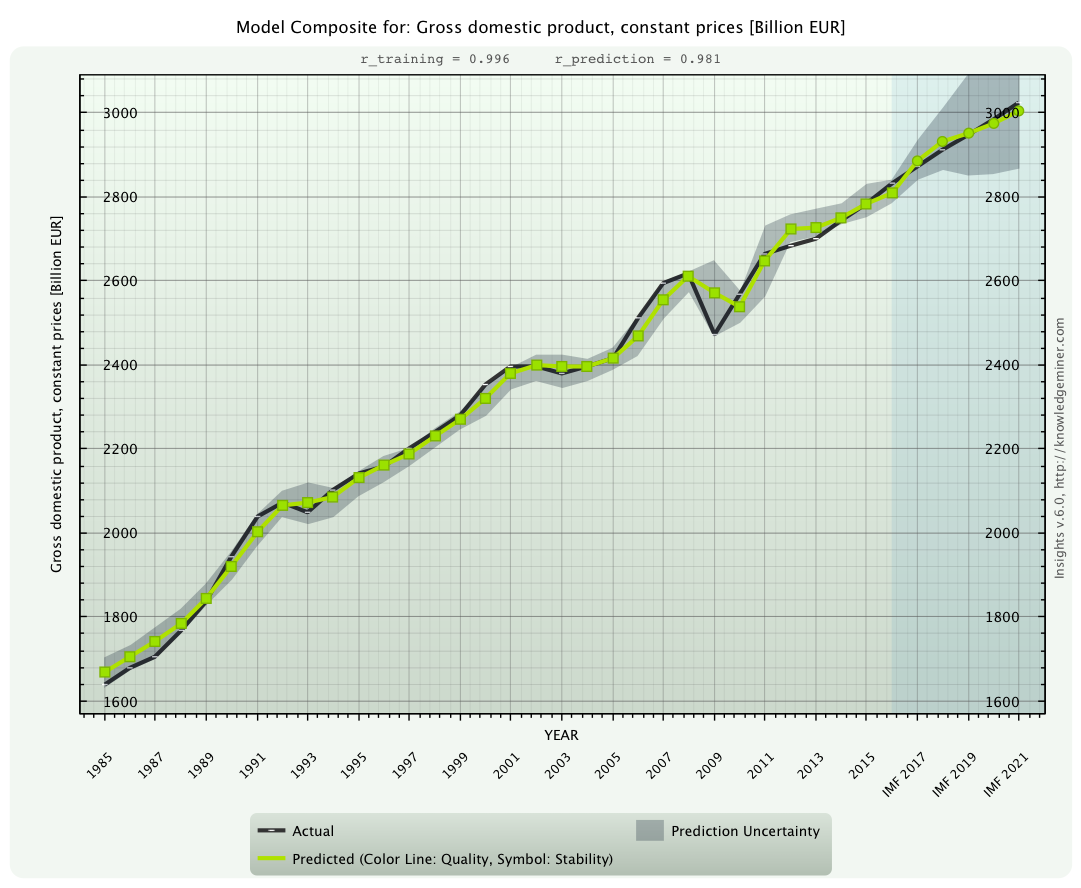

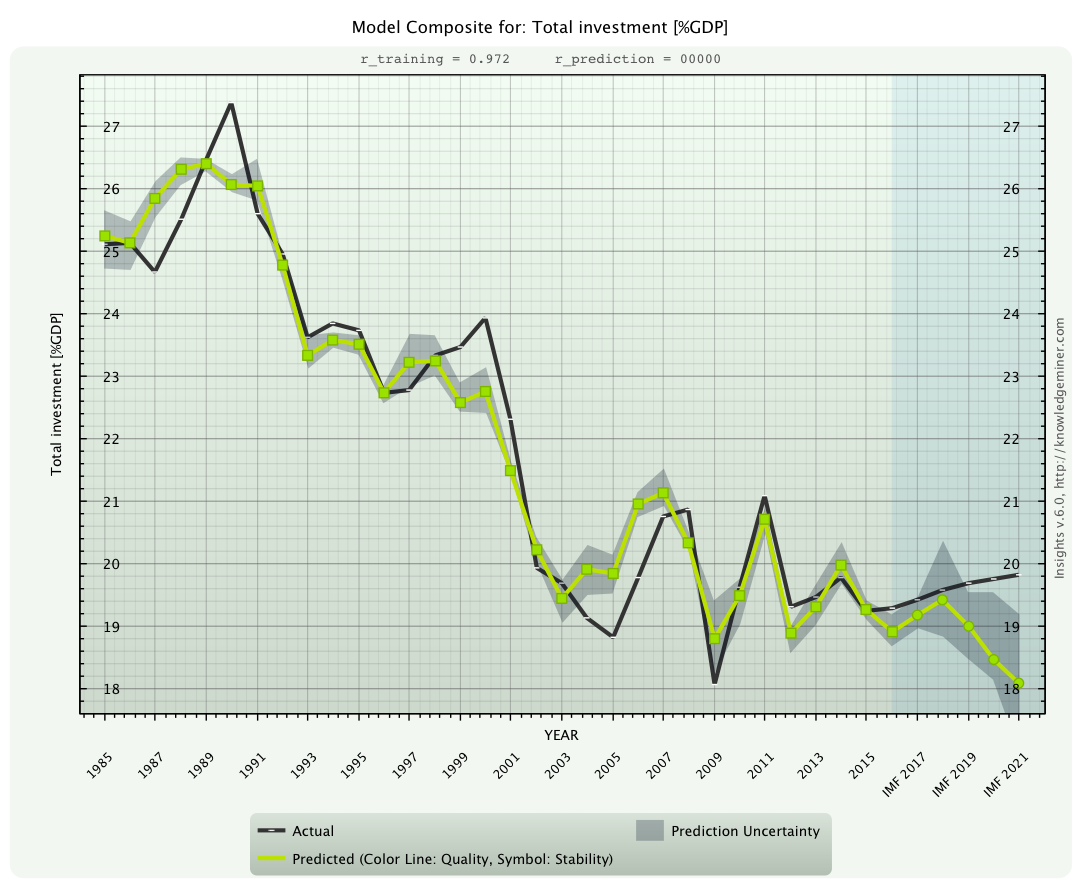

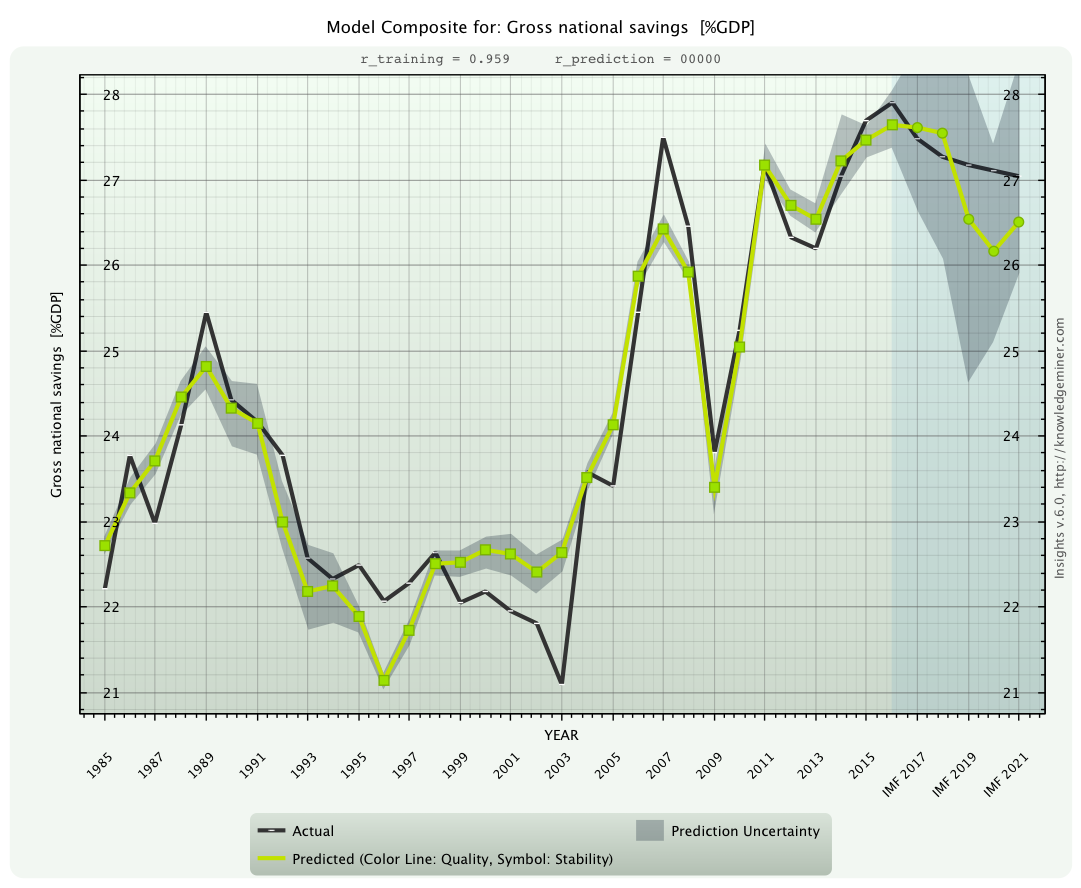

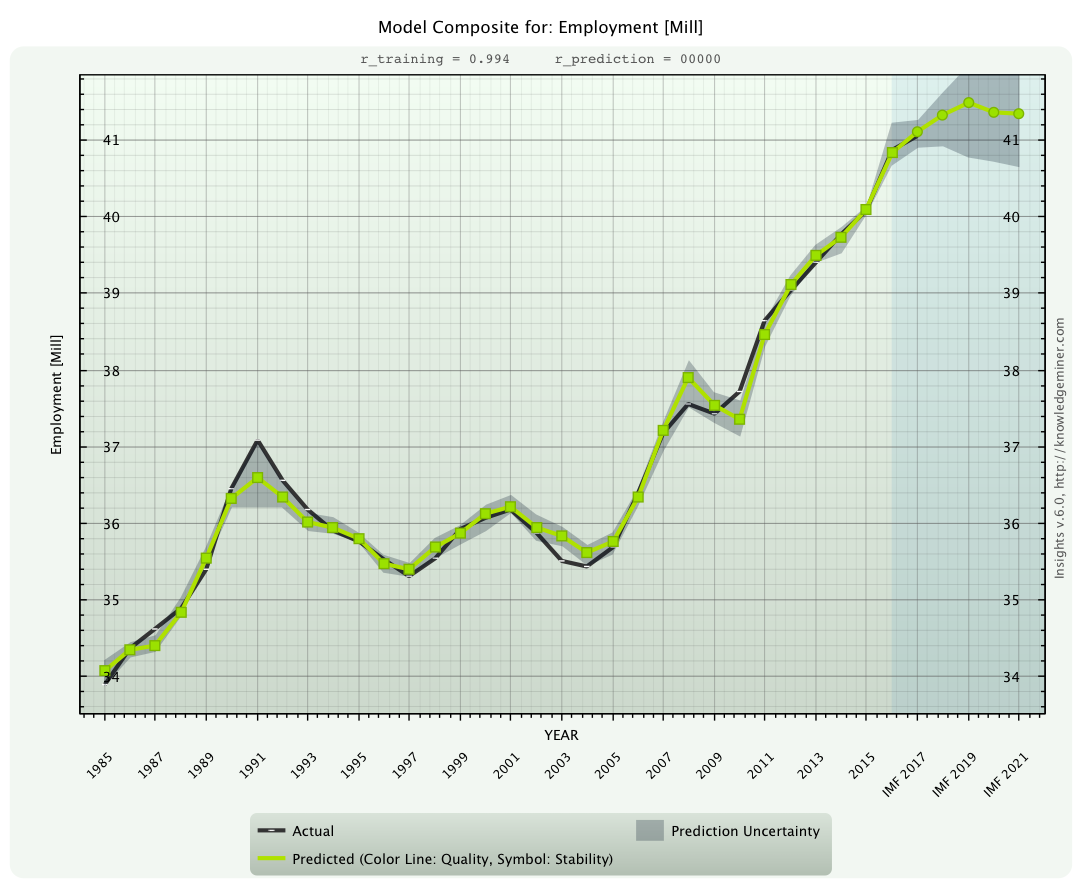

Out of the set of developed system models Insights automatically generates a number of forecasts of all 13 endogenous system variables five years ahead to reflect model and forecasting uncertainty. This is similar to ensemble or scenario forecasting with a most likely forecast and a forecasting interval for each variable and forecasting step individually. These Insights forecasts are compared to the IMF forecasts, which, however, only provides a single, crisp forecast for each variable. Figures 3 to 6 show these forecasts for:

x7 - Total investment [%GDP]

x8 - Gross national savings [%GDP] and

x13 - Employment [Mill]

compared to the IMF forecast (black line).

compared to the IMF forecast (black line). A divergence of forecasted trends is clearly visible.

compared to the IMF forecast (black line). This variable is connected with high uncertainty.

For this key economic parameter the IMF provided no complete forecast.

|

Try out free.

Start using the value of your data today.

|